Premier Explosives Ltd Share Price on NSE as of 11 September 2024 is 572.00 INR. You will find out the Premier Explosives Share Price Target 2024, 2025, 2026, 2027 and 2030. Premier Explosives Limited (PEL) is a prominent Indian company engaged in the manufacture and Premier Explosives Ltd. share price in 11 September 2024 on NSE is standing at 572.00 INR. With this piece of writing, you will come to know the Premier Explosives Limited Share Price Target 2024, 2025, 2026, 2027, and even up to 2030.

The company, the share price of which you are researching, is an Indian-based firm providing an extensive range of explosives manufacturing and supplying. It all started in the year 1980 at Hyderabad, in India. The birth of Premier Explosives took place. Core business areas include mining, construction, and defense. The company has a host of detonator products, explosive products, and rocket propellant products.

Key Areas of Focus:

Manufacturing: Explosives Manufacturing is a leading manufacturer of a range of explosives in bulk and packaged forms for both mining and construction applications.

Defense Solutions: The company manufactures customized ammunition and explosives for military use, particularly rocket propellants.

Innovation: At the very core of Premier Explosives are research and development in safety, efficacy, and performance.

Business Strategy: To stay at the top consistently, the company will work on technological innovations, strategic partnerships, and market presence in expansion.

| Detail | Information |

|---|---|

| Official Website | www.premierexplosives.in |

| Founded | 1980 |

| Headquarters | Hyderabad, India |

| Number of Employees | Approximately 1,200 (as of the latest data) |

| Category | Share Price |

About the Company: The Company, Premier Explosives Ltd. is an Indian company manufacturing and supplying mainly a wide range of explosives and detonators for use in mining, construction, and defense sectors. Other interests of the firm lie in the manufacture of rocket propellants and other specialized types of ammunition. Innovation and quality have awarded it high regard – PEL is one of the prime leaders in the field of explosives in India.

Current Market Overview of Premier Explosives Share Price

| Metric | Value |

|---|---|

| Open Price | ₹560.050 |

| High Price | ₹587 |

| Low Price | ₹569 |

| Current Price | ₹572.00 |

| Market Cap | ₹1.23 B |

| P/E Ratio | N/A |

| Div Yield | N/A |

| 52-Wk High | ₹995.044 |

| 52-Wk Low | ₹569.019 |

Recent Performance Analysis:

- Open: The price level at which the stock opened. It is the day’s starting point for the stock.

- High Price: The highest price reached by a share in the course of a day.

- Low: The lowest price level of a security that traded during the day.

- Current Price: Current or prevailing price at which the stock is traded.

- Market Capitalization: Total market value of all outstanding shares of a company.

- P/E Ratio: the ratio depicts what price of a stock in relation to its per share earnings.

- Dividend Yield: The amount of the annual dividend paid per share, divided by the current stock price.

- 52-Wk High/Low: A high and low price over the last year of the stock’s trade.

- Projected Growth: The growth rate of the stock that is estimated for a certain period of time.

Read Also:- ECOS Mobility Share Price Target 2024, 2025 To 2030 Prediction

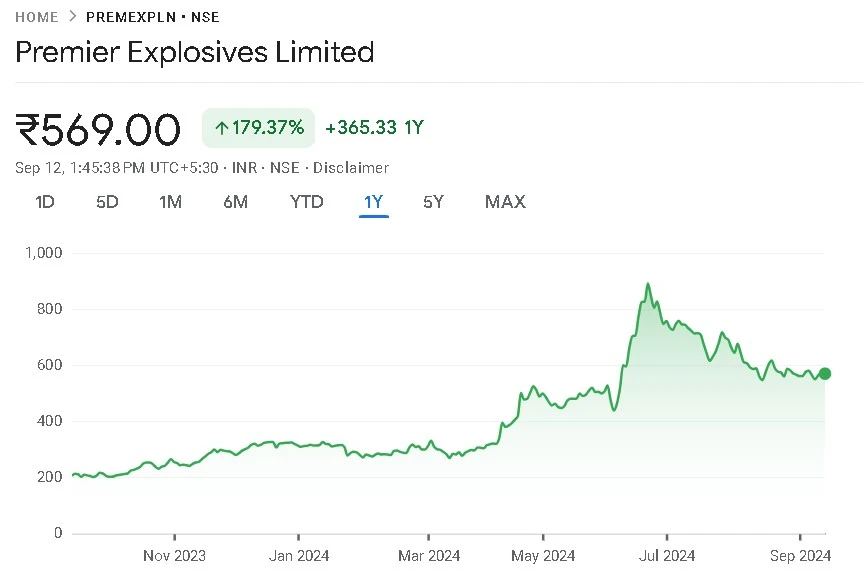

Premier Explosives Share Price Chart

Premier Explosives Share Price Target (2024 to 2030)

Projected Share Price Targets:

| S. NO. | Premier Explosives Share Price Target Years | Share Price Target |

|---|---|---|

| 1 | Premier Explosives Share Price Target 2024 | ₹ 706.684 |

| 2 | Premier Explosives Share Price Target 2025 | ₹ 952.235 |

| 3 | Premier Explosives Share Price Target 2026 | ₹ 1381.816 |

| 4 | Premier Explosives Share Price Target 2027 | ₹ 1815.583 |

| 5 | Premier Explosives Share Price Target 2028 | ₹ 2266.286 |

| 6 | Premier Explosives Share Price Target 2029 | ₹ 2657.779 |

| 7 | Premier Explosives Share Price Target 2030 | ₹ 3081.876 |

The chart below visualizes the projected share price targets for Premier Explosives from 2024 to 2030.

Analysis:

- 2024 Target: Short-term growth at some prevailing market trends and company performance.

- 2025-2027 Objectives: Medium-term forecast considering sectoral developments and financial situation.

- 2028-2030 Objectives: Long-run forecast based on strategic decisions and market trends.

Key Factors Affecting Premier Explosives Share Price Growth

- Market Demand for Explosives:

- Industry Demand: Other industry needs would be met from the mining work and infrastructure.

- Sectoral Trends: An increase in defense contracts and civil engineering, therefore, may affect the financial performances of the company.

- Government Policies and Regulations:

- Regulatory Environment: Safety regulations and environmental policies are subject to changing operational costs as well as compliance.

- Defence Spending: Government spending on defence would determine the revenue that would accrue from its defence contracts.

- Global Economic Conditions:

- Economic Cycles: Economic expansion or contraction influences the industrial activities and demand for explosive products.

- Inflation And Interest Rates: On the other hand, economic factors including inflation and interest rates could also affect spending and investment.

- Technological Advancements:

- Innovation: Improvement in explosive technologies should pay off in increased efficiency, hence less cost.

- Safety and Compliance: Changes in safety technologies and compliance can affect the operational performance of an organization.

- Competitive Landscape:

- Industry Competitors: The implication is concerned with market share and pricing undertaken by other competitors in the explosives industry.

- Market Position: The ability of Premier Explosives to maintain a competitive edge through innovation and quality of service.