When looking into Mercury EV-Tech, understanding its prospects is crucial. You’ll discover the Mercury EV-Tech share price targets for 2024, 2025, 2026, 2027, and as far as 2030. With the electric vehicle (EV) sector growing rapidly Mercury EV-Tech is a player to watch closely. investors are increasingly eyeing this stock to capitalize on its potential. Let’s dive deeper into the company details and the factors driving its performance.

Mercury EV-Tech Company Details

| Category | Details |

|---|---|

| Official Website | Mercury EV-Tech |

| Founded | 2018 |

| Headquarters | Mumbai, Maharashtra, India |

| Number of Employees | 1,500+ |

| Category | Share Price |

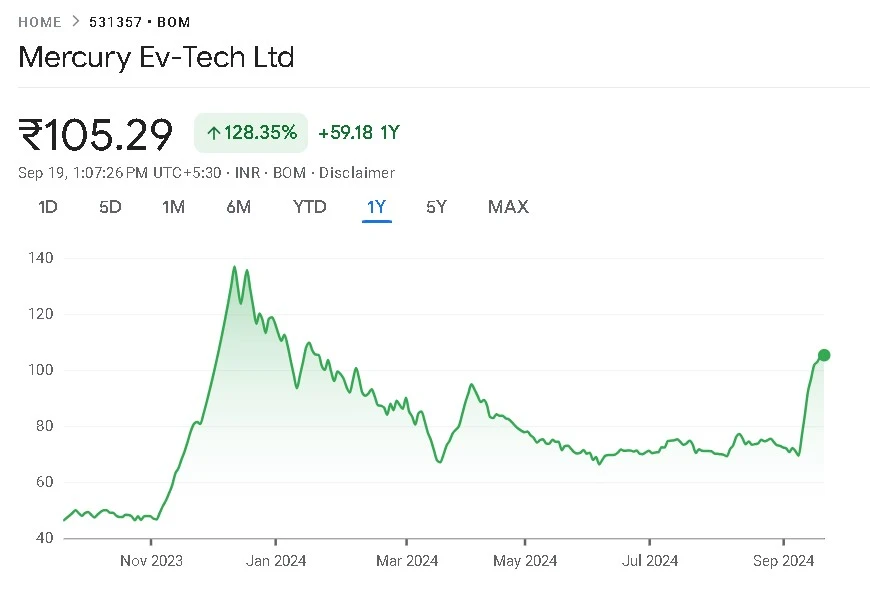

Current Market Overview Of Mercury EV-Tech Share Price

Here’s a detailed look at Mercury EV-Tech’s current market performance:

| Category | Value |

|---|---|

| Open Price | ₹105.00 |

| High Price | ₹108.00 |

| Low Price | ₹101.10 |

| Current Price | ₹105.37 |

| Market Cap | ₹18.48B INR |

| P/E Ratio | 1,035.40 |

| Dividend Yield | N/A |

| 52-wk High | ₹143.80 |

| 52-wk Low | ₹43.45 |

Mercury EV-Tech Share Price Target Tomorrow From 2024 To 2030

Based on the analysis, here is an approximation of the price targets of Mercury EV-Tech Share Price over the coming years. These are based on market forecasts and company growth prospects in the growing EV sector.

| Year | Minimum Target Price (INR) | Maximum Target Price (INR) |

|---|---|---|

| 2024 | ₹130.00 | ₹160.00 |

| 2025 | ₹140.00 | ₹180.00 |

| 2026 | ₹160.00 | ₹190.00 |

| 2027 | ₹210.00 | ₹250.00 |

| 2030 | ₹370.00 | ₹420.00 |

Read Also: Hindustan Zinc Share Price Target 2024, 2025 Upto 2030 Prediction

Key Factors Affecting Mercury EV-Tech Share Price Growth

- Growth in EV Market: Electric vehicles are driving major growth factors for Mercury EV-Tech Share Price Target 2030, as the primary growth factor is electricity demand.

- Government policies: Green policies like a subsidy on EVs will multiply the revenue of the company by many folds.

- Technological Innovation: With Mercury EV-Tech R&D investments, improving the efficiency of the battery and lowering its cost could push stock value up.

- Global Competition: Global competitiveness can potentially degrade pricing power and marginal income.

Mercury EV-Tech Share Price Chart

Bull Case

- Electric Vehicle Inflows: While some other countries move towards electric vehicles, Mercury EV-Tech stands to gain in terms of a rising order book.

- Innovation and R&D: The company would be able to get a cost-effective and efficient model of EV, which would keep the company in step in the global markets.

- Strategic Deals: With the technology companies and the battery makers, sparking long-term growth.

Read Also: Heritage Foods Share Price Target 2024, 2025 Upto 2030 Prediction

Bear Case

- High Competition: The business of EVs is also very competitive, especially for the big players dominating the world scene, which may limit Mercury EV-Tech’s share of the market.

- Regulatory Risks: Any policy change unfavorable to the electric vehicle might affect profitability.

- Supply Chain Issues: Raw-material shortages, such as battery raw materials, can cause disruption and more directly affect share price behavior.

Should I Buy Mercury EV-Tech Stock?

Given the strong growth potential in the EV sector, Mercury EV-Tech offers an attractive option for long-term investors. However, it’s essential to weigh the risks—particularly supply chain disruptions and competition. If you’re looking to tap into the expanding EV market, Mercury EV-Tech may be a solid addition to your portfolio.

The investment prospect in Mercury EV-Tech is pretty huge, mostly for those willing to reap the benefits of growing PV. It has an incredibly strong grip on the market. Its strong demand for green technologies and strategic innovation focus make it highly promising for long-term investors. But like other stocks, there’s an attached risk itself, especially while trading in the domain where regulations are-changing and competition peaks at its zenith.

Conclusion

It would likely be one of the big plays on electric vehicle space going forward with promising share price growth over the coming years. A bullish investor on future prospects for EVs is bound to find mercury EV- tech as a rewarding investment opportunity. Not even the threat posted by competition from other players and risks created by extrinsic factors should be treated lightly.

FAQs

What is Mercury EV-Tech’s current share price today?

Quoted stock as of September 11, 2024, is at ₹160.00 INR.

What could be the share price targets for the next years?

The target is set at ₹160.00 for 2024, increasing to ₹370.00 in 2030.

Be it an excellent time to invest in Mercury EV-Tech?

This is a good long-term investment, assuming the person is positive about growth in electric vehicles and possible innovation by Mercury EV-Tech.