Central Depository Services (India) Ltd, typically abbreviated as CDSL, today we analyze CDSL Share Price Target till 2024, 2025, 2026, 2027, and even 2030. is one of the two major depositories in India and makes up a very important constituent of the country’s financial segment. Formed in the year 1999, the company offers depository services including the dematerialization of securities and facilitation of transactions along with providing an electronic platform for investors trading in stocks. CDSL occupies a unique position in the financial market, becoming an indispensable contributor to the growing world of securities in India.

You will find the real health condition of the company and the prospect of growth that impacts the stock prices of CDSL during the upcoming years.

CDSL Company Details

The information on CDSL includes the site, year founded, headquarters, and the number of employees working there, as well as the business category.

| Category | Details |

|---|---|

| Official Website | www.cdslindia.com |

| Founded | 1999 |

| Headquarters | Mumbai, Maharashtra, India |

| Number of Employees | 600+ |

| Category | Share Price |

Read Also: BEL Share Price Target 2024, 2025 Upto 2030 Prediction

Current Market Overview of CDSL Share Price

For an improved view, here is a snapshot of some of the most important financial metrics of CDSL. All the figures have represented CDSL’s share performance till the latest trading day.

| Metric | Details |

|---|---|

| Open Price | ₹ 1,471.80 |

| High Price | ₹ 1,479.80 |

| Low Price | ₹ 1,457.65 |

| Current Price | ₹ 1,463.35 |

| Market Cap | ₹ 305.38B |

| P/E Ratio | 63.69 |

| Dividend Yield | 0.65% |

| 52-Week High | ₹ 2,989.00 |

| 52-Week Low | ₹ 1,262.00 |

CDSL Share Price Target Tomorrow From 2024 to 2030

Therefore, it would depend on its business model, market condition, and long-term growth opportunities by CDSL. The probable targets for the price of CDSL Share Price Target from 2024 to 2030 are as under:

| Year | Minimum Target Price (₹) | Maximum Target Price (₹) |

|---|---|---|

| 2024 | ₹ 1,350 | ₹ 1900 |

| 2025 | ₹ 1932 | ₹ 2915 |

| 2026 | ₹ 2404 | ₹ 3249 |

| 2027 | ₹ 3599 | ₹ 4304 |

| 2030 | ₹ 8825 | ₹ 9142 |

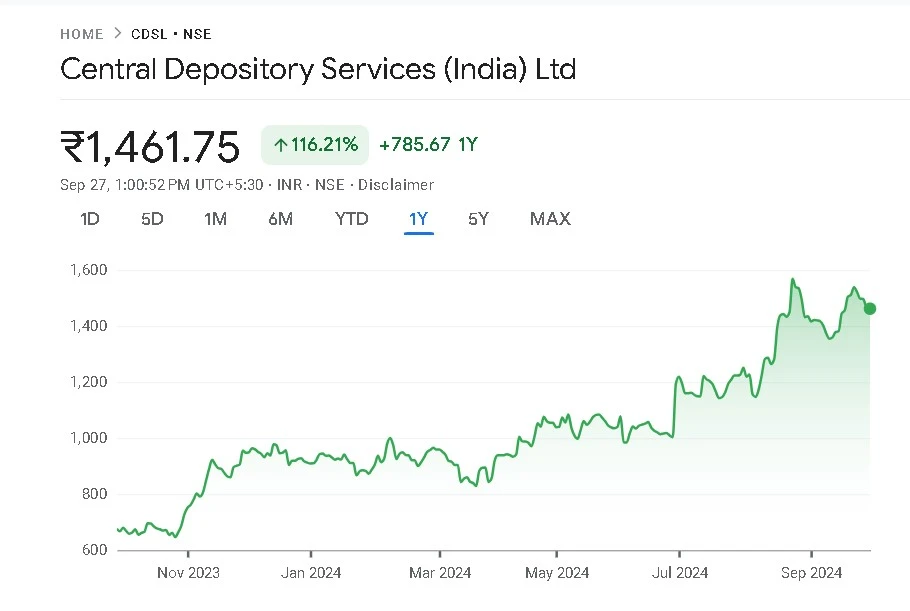

CDSL Share Price Chart

Key Factors Affecting CDSL Share Price Growth

The major influences on the share price, about understanding the all-round view of the future performance of the stock in CDSL, are as follows:

Bull Case:

- Increasing Retail Investor Participation: The larger proportion of Indians opening demat accounts and investing in equities bolsters the potential of CDSL Share Price target 2025.

- Government Support toward Digitalization: CDSL offers electronic services, which fall in line with the Government’s vision for a digital economy, making it poised for growth.

- Expansion in the Financial Markets: As the Indian stock market expands and new instruments start coming online, CDSL Share Price Target will capture an increasingly larger share of the depository services market. you may also like Rama Steel Share Price Target 2030

Bear Case:

- Regulatory Risks: Changes in regulations related to the depository services industry could adversely affect CDSL’s business operations.

- More Competition: There is also another large depository called NSDL, which makes the environment very competitive and, therefore needs to limit its pricing power.

Should I Invest in CDSL Stock?

The strong market position in the country where investor participation is building up makes it a very attractive investment. Again, entirely subject to personal risk appetite and investment horizon, CDSL Share Price 2030 could be quite an interesting play for those looking for a long-term play on India’s stock market growth addition to any portfolio due to its solid financials and consistent market leadership.

Conclusion:

CDSL is one of the niche players in the Indian financial market, giving critical services that are crucial to the growing number of investors across the country. Its strong market presence, positive growth prospects, and many more aspects invest in long-term investors. These elaboration factors involved in this post along with the share price target for 2024, 2025, and so forth might help investors looking forward to including it in their portfolios.

FAQs

1. What is the market price of CDSL shares currently?

The share price of CDSL can be accessed on Moneycontrol or Google Finance.

2. Will the price of the shares of CDSL rise after five years?

Analysts said that there will be steady growth in CDSL because of higher retail participation in Indian stock markets and the very nature of financial services getting digitalized.

3 Is CDSL a good long-term investment?

From the market position and role in the financial infrastructure of India, one would say that CDSL is a good long-term investment opportunity, especially to those who believe in the long-term growth of the Indian stock market.

4. How does CDSL earn its revenue?

The firm earns revenues on transaction charges, account maintenance fees, corporate action fees, and many other services it provides to investors and financial institutions.

5. How to Invest in CDSL Stocks?

The shares of the company are available in NSE and BSE. A shareholder could buy his shares from any licensed broker.