NTPC Limited, formerly National Thermal Power Corporation, today we analyze NTPC Share Price Target for 2024, 2025, 2026, 2027, and 2030. NTPC is one of the largest firms that critically contributes to powering the nation’s development. Being a public undertaking, NTPC Share Price for years had been considered to be a leader in power generation and had a big share in contributing to the energy requirements of India.

We will be covering this company’s financial statements, markets, and projects for the upcoming years to get answers on whether NTPC stock price should be kept on your watchlist.

NTPC Company Details

Let’s start by taking a look at some basic details about NTPC:

| Category | Details |

|---|---|

| Official Website | www.ntpc.co.in |

| Founded | 1975 |

| Headquarters | New Delhi, India |

| Number of Employees | 19,000+ |

| Industry | Share Price |

Current Market Overview of NTPC Share Price

Here is an in-depth snapshot of NTPC’s current stock market performance. The table includes crucial metrics to help assess the company’s current valuation:

| Metric | Details |

|---|---|

| Open Price | ₹ 436.00 |

| High Price | ₹ 442.50 |

| Low Price | ₹ 433.50 |

| Current Price | ₹ 436.90 |

| Market Cap | ₹ 4.24T |

| P/E Ratio | 19.93 |

| Dividend Yield | 1.76% |

| 52-Week High | ₹ 442.50 |

| 52-Week Low | ₹ 227.75 |

NTPC Share Price Target from 2024 to 2030

Hence, here is a share price projection for NTPC Share Price Target for several years to come. The projections are based on company performance, sector trends, and growth potential.

| Year | Target Price (₹) |

|---|---|

| 2024 | ₹ 479 |

| 2025 | ₹ 549 |

| 2026 | ₹ 628 |

| 2027 | ₹ 720 |

| 2028 | ₹ 825 |

| 2029 | ₹ 946 |

| 2030 | ₹ 1083 |

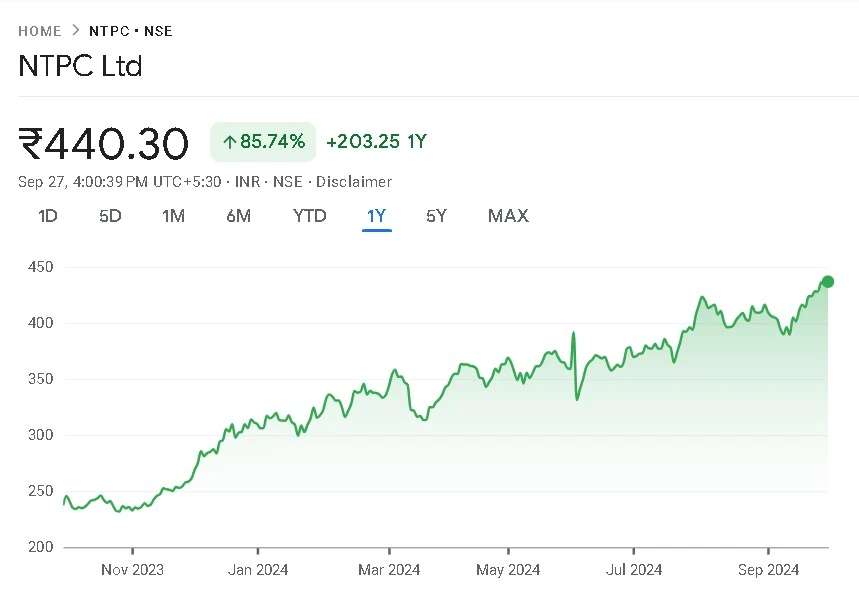

NTPC Share Price Chart

Key Factors Affecting NTPC Share Price Growth

A couple of important levers will play out for the share price growth in NTPC going forward. Here’s the bull and bear case:

Bull Case:

- Further advancing into renewable energies, NTPC proposed raising the share of renewable energy projects to more than double—both in solar and wind power—making it well placed for future growth in line with global trends for energy.

- Government Support: Being a state-owned enterprise, NTPC Share Price Target gets support from the Indian government, keeping in view that the dominant policies are still under implementation to enhance power infrastructure and capacity.

- Stable cash flows: This power purchase agreement further stabilizes the cash flows for NTPC Share Price India for many years. They are not susceptible to market fluctuations.

Read Also: GVK Power Share Price Target 2024, 2025 Upto 2030 Prediction

Bear Case

- Legacy dependence on thermal power based on coal: Since the whole world is opting for greener alternatives, reliability could be an issue in long-run profitability.

- Regulatory risks: Since it is a government body, political factors may pose a regulatory risk besides being challenging to the operating efficiency and financial performance.

- Growing environmental issues and the need to lower the carbon footprint may hike the cost as well as raise stringent rules on the old plants in NTPC.

Should I Buy NTPC Stock?

Investment in NTPC stocks offers a personal investment goal and risk tolerance. NTPC is largely considered a secure investment because of its strong government affiliations and a slow but steady cash flow. Therefore, it will be a rather safe bet for long-term investors who seek an entrance to the growing energy demand of India and transition to renewable sources of energy.

However, looking at the larger issues that the company faces itself-moving more slowly toward cleaner energy sources and having a bigger dependence on coal-it can seriously be doubted that the stock movements will be exciting for any short-term investor interested in more volatile or high-growth sectors.

Conclusion:

NTPC is still one of India’s largest energy players and well-positioned for future growth through a diversified energy portfolio, as narrated by 2024, 2025, 2026, 2027, and 2030 NTPC share price targets. Results are expected to be steady growth should the company hold fast on its shift to renewable energy while maintaining stable cash flows.

This comes along with the dangers of regulatory changes and environmental factors, but NTPC will provide stability and a long-term gain and thus is a sound investment in the energy sector.

FAQs

1. What is the current NTPC share price?

We can see the price of NTPC stock on any financial website like NSE, BSE or money control.

2. What’s in it for NTPC?

With overall growth expected from the expansion of renewable energy, along with sustained support gained through government initiatives in increasing India’s energy capacity, NTPC should grow.

3. Is NTPC a good long-term investment?

NTPC enjoys very stable long-term investment prospects, well-supported cash flows, solid backing, and a major role in the Indian power sector.

4. What is the risk of investment in NTPC?

Other potential drags on long-term growth include regulatory changes, environmental pressures, and reliance on coal-based power generation.

5. Share of NTPC How to obtain?

NTPC shares are traded in the NSE as well as BSE. You can acquire these from your internet trading account or through any registered broker.