IRCON International Ltd is one of the infrastructure giants in India. Today we analyze the Ircon Share Price Target 2024, 2025, 2026, 2027 as well as 2030. The company does large projects on rail and highways. As IRCON goes global, then the shares are of great interest to international investors. Here will discuss the stock performance of the company as it describes the growth prospects up to 2030 with its 2024 price target.

If you’re interested in long-term gains from a stable company that’s at the center of India’s infrastructure development, this analysis is for you.

About IRCON

IRCON International Ltd is a public sector enterprise. Incorporated in 1976, it functions under the India Ministry of Railways. Other than railways, it also executes work on highways, airports, and bridges. The government support along with several projects make this a good investment.

Key Details About IRCON:

- Industry: Infrastructure & Construction Industry

- Ownership: Public Sector Undertaking (PSU)

- Infrastructural projects include: (Railways Highways Bridges Airports)

- Headquarters: New Delhi, India

- Market Capitalisation: ₹11,000 crores (as of October 2024)

Current Stock Performance

The stock market is good for infrastructure stocks until 2024. Latest Stocks Metrics:

| Stock Metric | Details |

|---|---|

| Current Price | ₹ 218.80 |

| Open Price | ₹ 219.97 |

| Close Price | ₹ 225.16 |

| Day’s High | ₹ 222.72 |

| Day’s Low | ₹ 218.52 |

| 52-Week High | ₹ 351.60 |

| 52-Week Low | ₹ 127.25 |

| Volume Traded | ₹ 2,793,904 |

| Market Cap | ₹ 206.97B |

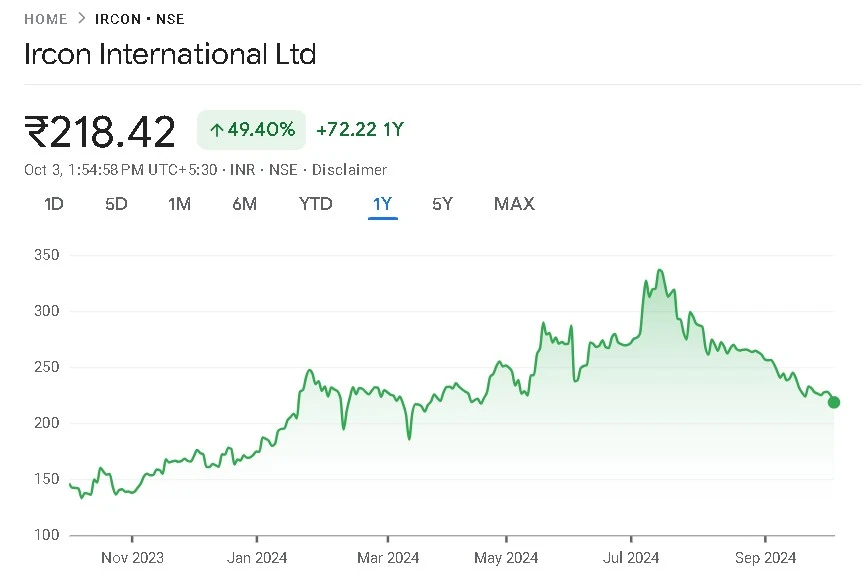

IRCON Share Price Chart

IRCON Share Price Prediction 2024 2030

The corporation IRCON Share Price Target is looking forward to massive growth in the following years. That is due to increased government infra spending. The targets for IRCON share prices from 2024 to 2030 are as follows:

| Year | Minimum Price | Key Market Drivers |

|---|---|---|

| 2024 | ₹293.25 | Increased govt. railway spending |

| 2025 | ₹381.35 | Global expansion of rail projects |

| 2026 | ₹465.95 | Completion of significant projects |

| 2027 | ₹549.91 | Entry into highways and airports |

| 2028 | ₹634.93 | Long-term project contracts |

| 2029 | ₹634.93 | Growth from urbanization efforts |

| 2030 | ₹776.55 | Continued market dominance |

Financial Performance Overview

IRCON Share Price has been posting constant growth both in revenue and net profit terms. The firm’s latest performance is reported below:

| Year | Revenue (₹ Crore) | Net Profit (₹ Crore) | EPS (₹) |

|---|---|---|---|

| 2020 | 5,391 | 485 | 5.16 |

| 2021 | 5,350 | 391 | 4.16 |

| 2022 | 7,380 | 592 | 6.30 |

| 2023 | 10,368 | 765 | 8.14 |

| 2024 (est.) | 12,331 | 930 | 9.88 |

Why IRCON is a Strong Investment Opportunity

- Government Backing: Investors now are interested in IRCON Share Price Target 2025 for the reason that it is a solid investment. Government Support: As a public sector company, IRCON has good government support. This therefore gives it constant orders and a sound position in the market.

- Diversification of the Project: IRCON diversified its business from railways to highways, airports, and bridges. Generally speaking, diversification reduces risk and increases revenue.

- Consolidated Financial Health: The revenue and profit trend within the company is truly consistent with steady long-term performance.

- International Expansion: No doubt IRCON is a very well-established company in India, but still under expansion in the international markets. This can attract multiple growth prospects for the stock price in the next few years.

Possible Risks for Investors

Although IRCON has numerous benefits, there are also a few risks which include:

- Delays by Regulation: Infrastructure regulatory aspects also reflect the same delays as land acquisitions and environmental clearances.

- Economic slowdown: The economic slowdown impacts governmental spending on some infrastructures that can hit IRCON hard on its project pipeline and revenue streams.

- Competition: The domestic companies are very aggressive when compared with the international companies. Hence, if the competition increased then the margins of IRCON would impact.

Short-Term Horizon: IRCON Price Target Tomorrow

IRCON share price target for tomorrow is a positive one for short-term investors, indicating the continuation of stable performance in the short run because of IRCON, wherein the present demand and more trading volumes have been increasing. Analysts suggest holding on to the stock or buying on dips since the company is continuing to acquire more contracts.

Conclusion

The stock of IRCON International Ltd is good long-term one for investors interested in the infrastructure sector. It is a stable choice with a sound financial background supported by the government. Its large project portfolio also adds an advantage. The share price of 2024 seems to have upward momentum. It may also be projected strongly for 2030.

Whether in the form of short-term investors seeking maximum returns or long-term investors looking for stability, there’s always a place for IRCON Share Price equity consideration. This should be tracked in government infrastructure spending and considered while taking international expansion into account for better investment decisions. The IRCON share price target for 2025 further projects the potential of this stock to garner immense returns.