If you’re exploring the financial giants of India, you’ve probably heard of HDFC Bank Share Price – it’s a name that rolls off the tongue when talking about trust, stability, and long-term growth. Known for its innovation and dedication to meeting customers’ needs, HDFC Bank offers a huge range of services for individuals and businesses. Whether you’re a fan of online banking, loans, or investment options, HDFC Bank’s got something for everyone.

This post will take you deep into everything about HDFC Bank share price, and targets ranging from 2024 to 2030. By the end, you will know exactly where the stocks of the banks are going or whether they should form part of your portfolio. Let’s get rolling!

Company Information HDFC Bank

| Attribute | Details |

|---|---|

| Official Website | www.hdfcbank.com |

| Founded | 1994 |

| Headquarters | Mumbai, India |

| Number of Employees | ~1,50,000 |

| Category | Share Price |

But HDFC Bank is also about growth – especially in digital banking with a huge team, cutting-edge tech, and a huge market presence, HDFC Bank Share Price Target has all the ingredients to continue leading the charge in India’s banking scene.

Current Market Overview of HDFC Bank Services Share Price

To understand where HDFC Bank’s stock could go, let’s start with the basics – here’s a quick peek at the numbers as they stand today:

| Metric | Value |

|---|---|

| Open Price | ₹1,726.15 |

| High Price | ₹1,764.00 |

| Low Price | ₹1,725.10 |

| Current Price | ₹1,760.95 |

| Market Cap | ₹13.44T INR |

| P/E Ratio | 19.42 |

| Dividend Yield | 1.11% |

| 52-Week High | ₹1,794.00 |

| 52-Week Low | ₹1,363.55 |

HDFC Bank Share Price Target from 2024 to 2030

So what’s the fuss with HDFC Bank share price in the future years? Want to know its projection? Here is an idea:

| Year | Minimum Target | Maximum Target |

|---|---|---|

| 2024 | ₹2040 | ₹2314 |

| 2025 | ₹2552 | ₹2806 |

| 2026 | ₹2904 | ₹3209 |

| 2027 | ₹3305 | ₹3707 |

| 2028 | ₹3932 | ₹4298 |

| 2029 | ₹4588 | ₹4963 |

| 2030 | ₹5199 | ₹5642 |

The projections would be that growth would be slow but steady and therefore good, stable, and thus a winner for long-term investors.

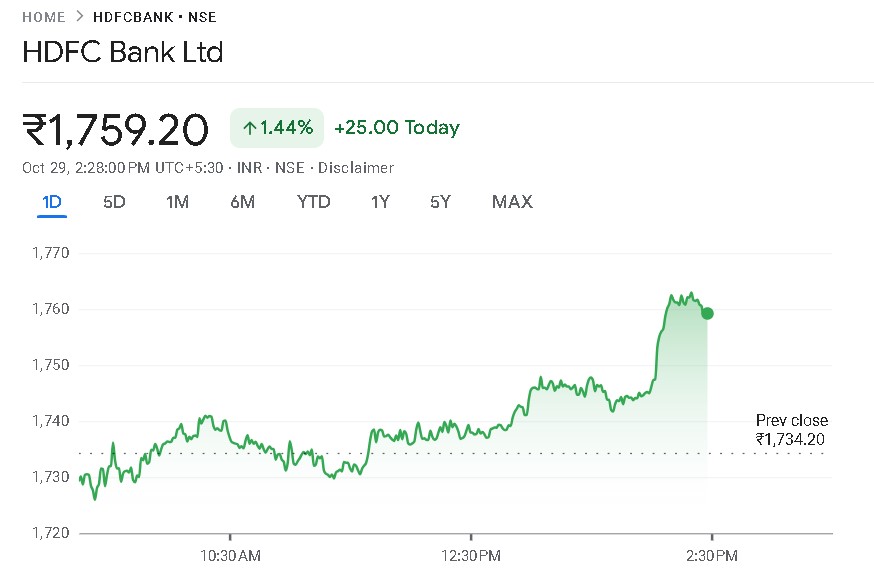

HDFC Bank Share Price Chart

Key Factors Affecting HDFC Bank Share Price Growth

The big news driving HDFC Bank nowadays has been what follows below to shape its future.

- Digital Play and Innovation: HDFC Bank is going all the way with technology, thus making digital services speedier and smoother for customer’s banking. Be it the apps, online banking, or next-gen products, the bank is placing an all-in bet on the technology. With a crowd of younger, tech-friendly people entering finance, the moves could enhance HDFC’s appeal and its bottom line.

- Economy: A good economy always brings good times for the banks. HDFC Bank is not an exception. It is one of the leading lenders and a healthy economy means loans and growth. But when it goes down? Well, banks feel the pain, and HDFC Bank is no exception. The bigger the economic boom, the better for HDF.

- Policies and Regulations: Like all other banks, HDFC Bank keeps an eye on Reserve Bank of India policies. Changes in regulations can have a direct impact on the lending rates and growth of HDFC. If it is in favor of lending, then HDFC stands to benefit. But when rules are strict? This may indicate some speed breakers in growth.

- Competition factor: Of course, banking is very competitive. HDFC Bank has to continually reinvent and reinvent itself due to the presence of other banks. Its competitors always keep breaking boundaries as well, and HDFC should also stay sharp to hold onto its edge.

Bull Case

Best-case scenario, HDFC Bank Share Price Target push on digital banking pays off big time. Profits could surge with a larger customer base attracted by its innovative offerings. More loans, more revenue, and fewer default worries mean a steady economic climate. Investors would have a big win, and share prices would reflect the growth in returns for long-haul investors.

Bear Case

On the other hand, in an economic slowdown, this will pull down the demand for loans as well. So, when the defaults increase during this period, HDFC Bank Share Price Target 2030 will be hit. Due to increased competition in digital banking, HDFC’s profit will be dented. That is where, in the bear case, this drag will weigh on the share price and slow its ascent. May Also Like Jio Financial Services Share Price Target

Should I Buy HDFC Bank Stock?

So, is HDFC Bank the right stock for you? If you’re someone looking for steady growth and a solid name in your portfolio, HDFC Bank Share Price has a lot going for it. It’s got stability, an eye on tech, and a rock-solid record. But remember – no stock is free from risk. Keep your timeline, risk tolerance, and financial goals in mind.

This company is one of the greatest players for long-term investment; however, if you just want to make some money quickly, then this company is not for you-this is for those who will hold their ground when markets go against them.

Conclusion

HDFC Bank Share Price is trusted in the financial world, especially in India. From its very inception, it has incrementally increased its offerings with balanced innovation and tradition. Analysts are positive that the prospects look bright with steady growth over the next couple of years. With strong numbers, a focus on tech, and a stable position in the market, HDFC Bank Share Price Target 2025 is a solid choice for any investor thinking of investing in a bank stock with long-term potential.

For those interested in the financial sector, HDFC Bank seems to have it all. If you’re looking for a stock that’s both reliable and forward-thinking, HDFC Bank Share Price could just be the one for you. —————————-

FAQs

Q1: Why is HDFC Bank’s stock price going up?

This HDFC Bank usually moves upwards with investment in technology, sound financial discipline, and stable loan and deposit growth.

Q2 Is HDFC Bank a Good Investment for a New Investor?

A: Yes. HDFC Bank has a very trackable history. It is ideal for the first-time investor looking for steady returns without too much risk.

Q3: How does HDFC Bank compare to other private banks?

A: HDFC Bank is one of the private banks in India. The services it offers are some of the best, as are its customers. Out of all, it would be safe to say it leads the others in the case of digital banking and customer experience.

Q4: Slowdown in the economy remain a threat to HDFC Bank share price?

A: Even with a slowing economy affecting growth, HDFC’s diversity and smart strategy will give it good ground to absorb the shocks of downturns.

Q5: Is HDFC Bank stock price 2025 a buy for the long term?

A: HDFC Bank is doing great for a long-term investor because it grew with its history, paid a consistent dividend, and is a market leader.