If you are a number person, this investment is certainly full of numbers. Knowing what makes the wheel turn at ABCapital Share Price Target and where they are going can change your point of view on this investment. This article outlines the projected ABCapital share price every year from 2024 to 2030. Let’s get along and see if this stock will meet your needs.

ABCapital Company Details

Capital has been playing a bit of a game in the financial services space for a little while. So, here’s the background of what makes this company tick and where they’re based, to set up a bit of context before we dive into share prices.

| Details | Information |

|---|---|

| Official Website | abcapital.com |

| Founded | 1996 |

| Headquarters | Mumbai, India |

| Number of Employees | 10,000+ |

| Category | Share Price |

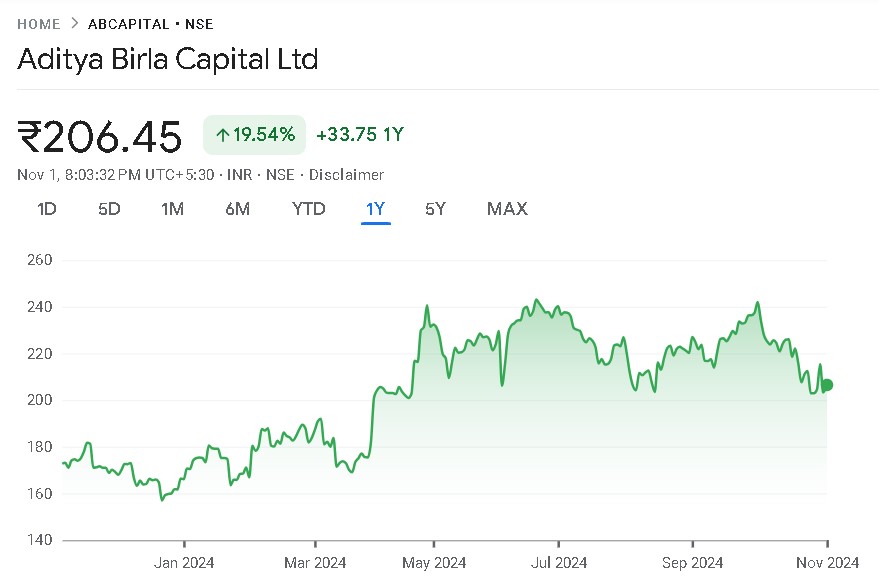

Current Market Overview of ABCapital Share Price

Let’s start with the here and now. How is ABCapital Share Price performing in the stock market? Here are its current statistics, ranging from the price at which it opens today, to its high, and low prices.

| Metric | Value |

|---|---|

| Open Price | ₹205.00 |

| High Price | ₹208.80 |

| Low Price | ₹204.16 |

| Current Price | ₹206.45 |

| Market Cap | ₹537.29B INR |

| P/E Ratio | 15.67 |

| Dividend Yield | N/A |

| 52-Week High | ₹246.90 |

| 52-Week Low | ₹155.00 |

ABCapital Share Price Target Tomorrow from 2024 to 2030

Now, here’s what you came for some predictions on the stock price of ABCapital. Nobody in the world can predict the future; however, these targets give a pretty good look at where experts believe that the stock might head in the next few years.

| Years | Projected Share Price (₹) |

|---|---|

| 2024 | ₹290.85 |

| 2025 | ₹320.74 |

| 2026 | ₹350.42 |

| 2027 | ₹380.11 |

| 2028 | ₹400.04 |

| 2029 | ₹420.84 |

| 2030 | ₹470.52 |

Price Target Summary:

- 2024: Some ups and downs, but most expect ABCapital Share Price to close 2024 around ₹280-₹300.

- 2025: By, 2025 things will reach around ₹320. If the company continues to gain momentum, it may reach even more.

- 2026: Now it becomes interesting. The projection says it would be about Rs 350.

- 2027: Highest during smooth sailing: 2027 may reach up to ₹380.

2030: If growth is steady and no setbacks occur, stocks might touch around ₹470.

All these will be shown visually in the price chart, how ABCapital Share Price may climb each year. It is this kind of trend long-term investors may find eye-catching.

ABCapital Share Price Chart

Key Factors Affecting ABCapital Share Price Growth

What drives the price of ABCapital Share Price up or down? Well, a few factors decide its growth, and let’s break it down.

- Industry Growth: ABCapital operates in the fast-growing financial services sector, especially in India. The sector is experiencing significant demand and ABCapital Share Price is well positioned to reap a larger share of the same.

- Technology Advancement: ABCapital is quicker to install technology-driven solutions to their operation and make them less cumbersome. Things go in a hurry and are hence more plausible, pleasing clients, that, in turn, draw new and also raise the income or share quotations.

- Economic Conditions: One giant. Economy, inflation, interest rate; all these factors play a role. When the economy is thriving, people invest more, and money in the banks gets utilized more significantly. But downturns or high inflation? Not so much.

- Regulatory Landscape: The financials have an entirely regulated business background and, therefore, change will either be beneficial or detrimental to the stock. Tax cuts for this industry will keep the stock of ABCapital high while stricter regulations will dampen things.

Now, let us see two visions of things ABCapital might do. and found RailTel Share Price Target 2024, 2025 Upto 2030

Bull Case

Best case, ABCapital Share Price is on a growth path. In that case, steady investor gains are likely, as it continues to expand its presence in new markets and adds more tech to its offerings. Imagine the stock price growing each year by 2030, some experts see this stock potentially doubling from where it is now. If it can deliver, ABCapital could be a real investment winner.

Bear Case

But, hey, no stock’s a sure bet. If the economy dips or ABCapital hits some bumps in its growth plans, it might slow down. And remember those strict rules? Any big changes in regulations or high inflation could be a drag on the stock. In this case, the stock might see a few rough patches. Even the most optimistic investors should keep these risks in mind.

Should I Buy ABCapital Stock?

So, is ABCapital worth your hard-earned cash? The truth is, this stock could be a great pick if you’re looking for long-term growth in the financial sector. It’s got a strong foundation, steady expansion, and a solid track record. But there’s always the risk factor. If you’re thinking of buying, ask yourself if you’re ready for potential swings.

If this industry excites you, and ABCapital’s experience aligns with your passions, then add this to your portfolio. Just keep in mind that every investment carries risk; watch the market and set your limits. And don’t forget that it’s your money at risk!

Conclusion

ABCapital is one of those stocks that keeps showing up on investors’ radars. With a solid outlook and a good growth path, it might just be a great investment over the next few years. But every stock has its ups and downs. By understanding both the strengths and the risks, you’re already one step ahead. Keep watching the numbers and keep learning. Who knows? AB could be an option that might allow you to be successful.

FAQs

Q: What is the current P/E ratio of ABCapital?

A: At present, it stands at around 18. The number itself indicates the ratio of trading of stock concerning its earnings.

Q: Does ABCapital pay dividends?

A: The Company has a dividend yield of about 2 percent per annum. That again is a bonus to its shareholders.

Q: Is ABCapital a good long-term investment?

A: ABCapital is growing steadily, especially through its tech push and standing in the industry. Do your own research and factor in your risk tolerance at all times.

Q: What would hurt the future share price of ABCapital?

A: Economic downturn, high inflation, or regulation can impact the stock. All these may take adverse turns in terms of return, especially when the whole industry performs poorly.

Q: Can it also reach ₹470.52 by 2030?

A: Possible! If the company maintains its curve of growth, and if the market condition is one of ease, some analysts feel it might be achievable. Remember, though, the projections are only those projections.