Talking about major names in the technological world, it is impossible to leave behind Wipro. Starting from a small business in 1945, this became a commodities-selling company that grew to become one of the biggest IT and business services firms. It cannot just be described as another firm as it changes the lives of millions through the technology and solutions for which it is recognized, reaching across many borders.

You are reading this because you’re interested in knowing Wipro share price target for the years 2024, 2025, 2026, 2027, and 2030. So, buckle up because this is your one-stop guide to what lies ahead. But first, let’s break the essentials, catch up with Wipro’s latest market statistics of course, and share price projections so you can make that call on investing.

Wipro Company Information:

To set the context, here’s a very brief snapshot of Wipro’s vital stats:

| Details | Information |

|---|---|

| Official Website | www.wipro.com |

| Founded | 1945 |

| Headquarters | Bangalore, India |

| Number of Employees | 220,000+ |

| Category | Share Price |

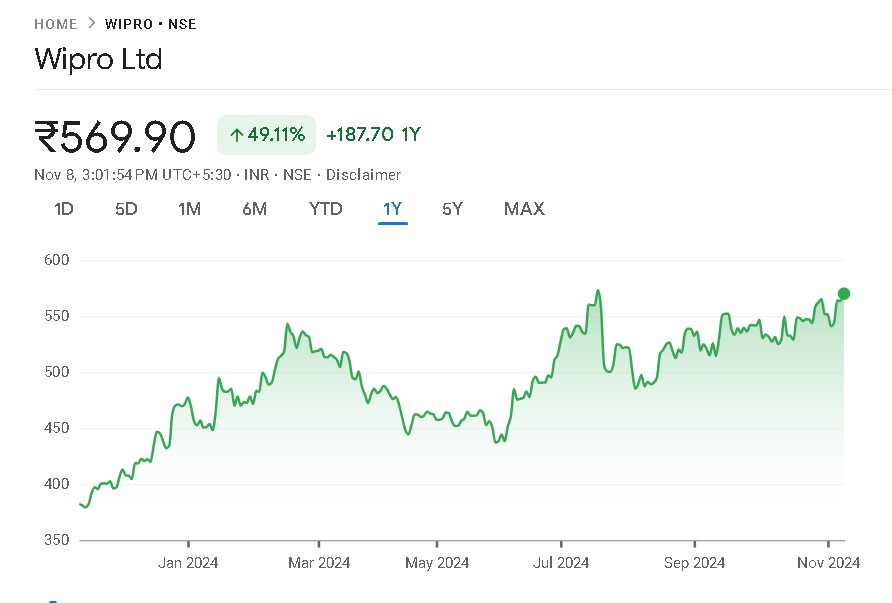

Current Market Overview of Wipro Share Price

How has Wipro fared in the current market? To know more about its recent stock movement, check the table below:

| Metric | Value |

|---|---|

| Open Price | ₹565.00 |

| High Price | ₹578.80 |

| Low Price | ₹565.00 |

| Current Price | ₹571.60 |

| Market Cap | ₹2.99T INR |

| P/E Ratio | 25.53 |

| Dividend Yield | 0.17% |

| 52-Week High | ₹579.90 |

| 52-Week Low | ₹377.00 |

Wipro Share Price Target from 2024 to 2030

You would be keen to know how Wipro’s stock is likely to shape up in the next few years. So, based on its recent performance, here are projected share price targets year by year, right up to 2030.

| Year | Predicted Price (INR) |

|---|---|

| 2024 | 590 |

| 2025 | 645 |

| 2026 | 690 |

| 2027 | 720 |

| 2028 | 750 |

| 2029 | 810 |

| 2030 | 900 |

You may also like: ITC Share Price Target 2024, 2025 Upto 2030

Wipro Share Price Chart

The Scoop on Wipro’s Stock Growth: Key Drivers

What may fuel the growth of Wipro in the years ahead? Here’s what you might want to know.

- New Contracts and Partnerships: Every contract it signs will be a mop-up for revenues and a way of staying ahead. The company, over the recent past, has been bagging big clients for services such as cloud computing, AI solutions, and cybersecurity- probably the hottest areas in the industry today.

- Global Economy Health: Since Share Price Target has customers all across the globe, the stock price is inversely proportional to the health of major economies and more specifically those of the United States and Europe.

- Tech Innovation: In an industry so fast-paced that it’s growing at warp speed, staying ahead is the difference. Much of their research investment in the tech field keeps Wipro competitive, considering how tough their stiff competitors are: TCS and Infosys.

- Competitive Pressure: Now, talk of competition. Wipro’s competitors are quite aggressive. If they manage to overtake Wipro Share Price Target 2025 on innovation or reduce costs further, it might hurt Wipro’s growth. So the competitive landscape needs to be followed.

Bull Case for Wipro Stock

Let’s discuss the upside: in a bull market, Wipro’s stock could explode towards those projections above and perhaps beyond. Here’s why:

- More Digital Demand: Everyone wants to go digital everywhere, and Wipro’s in the prime position to do so. More businesses joining the digital transformation bandwagon means more contracts, and therefore, much more revenue.

- Financial Discipline: Wipro Share Price is good with its cash. That it uses it well to build and innovate is a big deal for their investors. It was this discipline that kept Wipro’s stock stable even when markets got rough.

- Expanding Client Reach: The world is vast and so is Wipro’s reach. With increased grabs of clients in the developing world and niche industries, it is, preparing a bed for long-term success.

Bear Case on Wipro Stock

However, not everything is hunky-dory. What might take the stock of Wipro Share Price down is:

- Global economic Slowdown: Any kind of recession or fall in the world economy may force clients, for whom Wipro works, to retrench, and that will impact revenue. Firms cut back their IT expenditures during tough times.

- High Competition: The tech space is getting increasingly competitive. Competitors are not slowing down; if Wipro Share Price Target gets outpaces in terms of development in technology or ends up losing major clients, this stock might plunge.

- Currency Risks: By virtue of having international operations, Wipro Share Price may suffer from currency risks. Such risks may drastically impact it in the revenue earnings context when such earnings predominantly emanate from the overseas market.

Should I Buy Wipro Stock?

It’s got serious potential. For one, the company’s focus on digital innovation is strong. It’s diving into AI, cloud solutions, and cybersecurity major growth fields. Wipro Share Price has a solid foundation and a big market presence, and it keeps evolving. But in a fast-paced, high-risk world of technology, risks are real. Currency shifts and changes in global economies can also impact how Wipro fares.

So should you buy it? Yes if you believe in long-term growth, don’t mind the market swings, and want to invest in a stable tech player. You will not get that next hot stock that doubles overnight, but Wipro Share Price is safe and will continue to grow steadily in the long run.

Conclusion

Wipro Share Price Target has been around for the long haul and isn’t going anywhere. Projected stock prices from 2024 to 2030 reflect a promising climb, which reflects the company’s position and potential within the tech market. To those who think in the long term, this is indeed a good stock to look out for. It has its challenges, but innovation coupled with aggressive growth makes it one player that lasts. So, what’s the bottom line? If you’re all about steady growth with a tech focus, Wipro might just be the stock for you.

FAQs

1. In what does Wipro focus its business?

Wipro deals with IT, consulting, and business solutions. It offers digital transformation, tech consulting, and many other services to clients worldwide.

2. Why do investors think of Wipro stock as a good investment?

Wipro Share Price has assured steady, continuous revenue growth and remains in high-demand fields such as AI and cloud computing; hence, it is a good investment place if one is a tech stock investor.

3. Where are Wipro’s highest operations?

It is an Indian company whose most of its business is generated in North America and Europe. The company has recently just ventured into Asia and Africa.

4. Does Wipro pay dividends?

Yep, Wipro pays dividends regularly, with a yield of around 0.17%.

5. What could impede Wipro’s growth?

Wipro faces competition, slowdowns in the economy, and currency fluctuations that could affect its earnings and even stock value at such times.